Industri kulit sering kali dikaitkan dengan tantangan keberlanjutan, namun UD Nogosari Leather dari Kabupaten Lumajang…

Stretching the Local Sneaker Scenario After the Pandemic

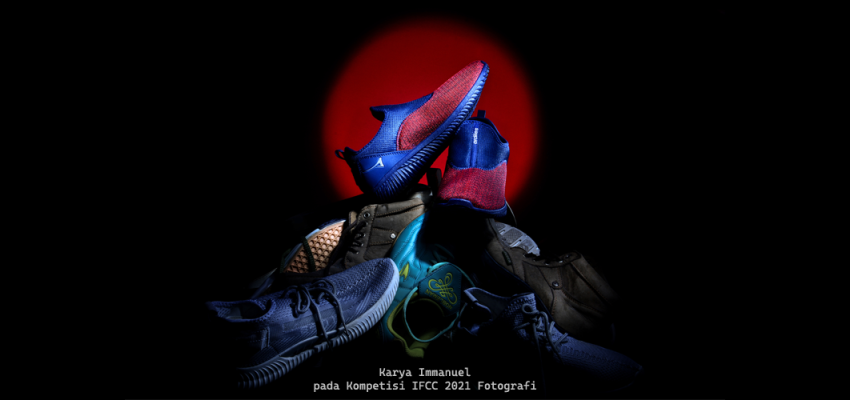

As a fashion subculture that grows and grows from the community, the development of the Indonesian sneaker scene cannot be separated from the incessant campaigns themed "localism". The emergence of the distro concept in the early 2000s was the first episode of the emergence of the sneaker subculture in Indonesia. The movement of the sneaker and streetwear fashion industry is increasingly massive, forming a new sneakerhead culture that is synonymous with community and hangouts.

In the early 2010s, the sneaker and streetwear fashion scene became more and more complete with the emergence of the potential for the denim industry which showed its huge market potential, so that the #localpride campaign wave started along with the very high market interest. At the beginning of this decade, the growth of new local sneaker brands exploded by pitting unique and bold design concepts and silhouettes against the hegemony of global brands that had previously hit the domestic market.

In 2015, the development of the quality of local brand footwear is getting better with attractive prices. In this period, the local sneaker brand scenario has already gained a place in the domestic market. The second wave of #localpride campaign continues to grow in such a way that sneakerhead culture is not limited to the community, but has penetrated all market segments, ages and has become an everyday identity.

Sneaker events that have been limited to the community have begun to be recognized by the general public who are interested in knowing more about sneaker culture. Through these events, the public increasingly understands that the domestic potential of local sneaker brands is very good and worthy of being used as a daily identity for anyone and anywhere. One of the important leaps in the Indonesian sneaker scenario is when President Jokowi uses locally made sneakers from Bandung in every state event. This momentum is one of the important timelines for the local sneaker industry in Indonesia. Since then, the trend in the community is talking about the local sneakers worn by the President.

Talking about data, 2015-2018 is the year for local sneakers in Indonesia. Although according to Aprisindo the local sneaker market is still 3%, the trend in the future will get better. Footwear SMEs in several centers in West Java, East Java, Baten and Jakarta flooded orders for the manufacture of local brand sneakers. The portrait of the footwear industry, especially sneakers in the 2015-2018 period, more than 80% of its production is done in partnership with IKM.

The development of social media has also become one of the keys to the leap in the local sneaker industry in the 2010-2018 period. The #localpride campaign has become more systematic, many fashion influencers have echoed the interest of the public, then become proud to use domestic products and finally become a new culture in fashion.

The pandemic hit all industrial sectors in early 2019 to 2021, including the footwear industry. Industrial growth had fallen to 8% in 2020, and again showed a positive trend with 7% growth in 2021. Based on data from Aprisindo, production value fell by 70-80% including employment down to 70% (including small-scale industry). medium and small). In early 2022, the performance of the national footwear industry showed a positive trend. Data from BPS shows that in the first quarter of 2022, the growth of the GDP of the footwear industry was 7.1 trillion rupiah with an export value of 1.9 billion USD.

Pasca pandemi dipastikan landscape industri sneaker berubah. Transformasi industri, supply chain, disrupsi digital, perubahan sosial merubah pola industri alas kaki domestik khususnya sneaker. Tidak seperti periode 2020-2021 dimana hamper seluruh IKM alas kaki pada mode survival, awal tahun 2022 kondisi secara umum telah membaik. Pelajaran berharga saat pandemi, membuat merk-merk lokal melakukan berbagai perubahan untuk bisa bertahan selama pandemi.

Based on BPIPI data, several local sneaker brands in general experienced an increase in turnover in the range of 10-20% compared to during the pandemic. With the reopening of offline events, the scenario of increasing sales and marketing strategies for local brands will be more intense online and massive offline. Current conditions show that after the COVID-19 pandemic is no longer a threat, market euphoria needs to be understood as a potential that can give new breath to the local sneaker scene.

Learning from the pandemic, based on data from BPIPI, there has been a market shift, especially in pricing and marketing strategies. Several big local brands that have been setting prices at high levels (above 500 thousand), currently tend to set prices at medium or even low levels (200 – 400 thousand). This is because the market potential with purchasing power in the range (100 – 300 thousand) has a very high volume. Some local brands with low- and medium-sized market segments have the ability to manage brands very well, so that even though they sell at low prices, they are still not cheap. So that this is an interesting lesson for several local brands that previously targeted the middle purchasing power (above 500 thousand) need to learn a lot to maintain a positive brand image even with the same market segment.

BPIPI's role in the footwear industry ecosystem, especially the local sneaker scene, focuses on (1) strengthening partnership relationships between local brands and IKM as the main production partners. SMIs as production partners must take advantage of market potential by providing quality service in a standard production process at an attractive price. (2) maintain the footwear industry ecosystem by providing information and knowledge for local brands about the importance of carrying out sustainable business practices.